How to Write a Check

In this post, we will discuss understanding and writing a check in a digital era. No matter if you’re a millennial, Generation Z, or seasoned businessperson, online banking and digital wallets are making check use rarer. However, there are still times when you need to write a check:

- You want to save some cash by avoiding credit card processing fees

- When the business doesn’t accept payment online

- You’re paying someone who doesn’t use electronic payments or has never been paid electronically before (i.e., grandma, the handyman you hired, street artists)

- You want to mail someone money but don’t want to send cash in via USPS

See? Checks still have a place in the world but if you rarely (or never) write them it can be difficult at first. The following tips are structured to help make the process easier and to ease some of the stress for you.

What is a check?

A check is a type of payment that you make by writing instructions on paper and signing them. The person that receives the check can then trade it with the bank for cash. The money is taken from your account when the person CASHES the check with the bank.

Where do I get my checks?

Usually, you get some checks from the bank when you open your account; when you find you need more you can reach out to the bank or go to one of the many sites offering “designer” checks with pretty pictures. Expect to pay for additional checks.

What are the parts to know when writing a check?

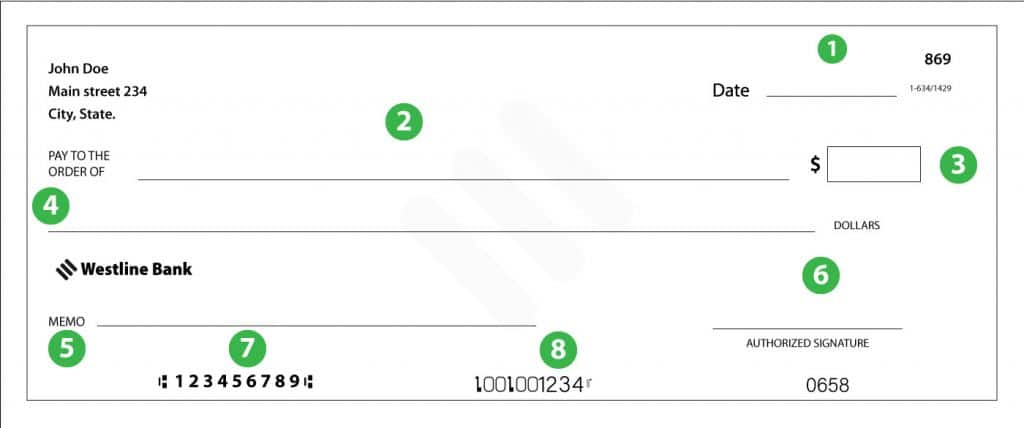

See the figure below for the key parts to look out for when filling in your own checks:

- Date—it is recommended you write the date in long form or at least MM/DD/YYYY to avoid tampering with the check (2/11/20 could be modified to 12/11/2021)

- Pay to—this is the recipent of the check. You should be as clear as possible on who is receiving the check (full name or full business name, no abbreviations)

- Amount written in numbers—fill the space to avoid tampering. For example 500.00

- Amount written out in words—this is where you will verify the amount in long form. For example: Five Hundred Dollars and Five Cents (or 5/100). Again, fill the space for security, even if you draw a line to the end

- Memo line—remember banks now offer digital scans of checks so this acts as a reminder for you in case you forgot to note what a check was for in your records. It can also be used to provide the recipient with directions to your account.

- Signature lines—sometimes two on a business check. This activates the check and makes it cashable. You should NEVER sign a check before it is filled out.

- Routing Number—this is used by the receiving back to find your bank. It’s like a financial tracking number

- Account Number—this is your specific account within the aforementioned bank. Sometimes the routing number and account number are strung together to make one line, but it is still just a financial tracking system.

Why fill out the memo line when writing a check?

The memo line (5) is the most important part of your personal checks because it’s what you use to set up automatic payments and track spending. This also helps the recipient know that this is a payment for them and why, as opposed to any other kind of bill they might have incurred during the month.

What are the account and routing numbers on my checks?

The account (8) and routing (7) numbers are on the bottom of your checks, often in two sets. If you need them you can also find them by logging into your bank’s website. The first part of the routing numbers tells the receiving bank where your account is located. The second part of the routing numbers tells the bank what your account number is.

When should I sign my name on a check?

NEVER sign a blank check, as this can allow someone to take whatever they want from your account. When you write a personal check, always sign the signature line with your name on it right before it goes to the recipient.

Hopefully, the information on this page will help you feel more comfortable writing checks in the digital age. A check gives you more security than cash when digital payments aren’t available because the funds are reversible if someone commits fraud–not an option with the cash you sent in your sister’s birthday card.